Today’s drive for environmental responsibility and energy efficiency has many homeowners seeking ways to make their homes more sustainable. The Energy Efficient Home Improvement Credit and associated federal HVAC tax credits offer valuable incentives for those looking to upgrade their homes. In this post, we'll explore the details and requirements of the Energy Efficient Home Improvement Credit and shed some light on a few of the impressive Lennox systems that can help you qualify.

Energy Efficient Home Improvement Credit

The Energy Efficient Home Improvement Credit is a federal tax credit designed to encourage homeowners to make energy-efficient upgrades to their homes. Introduced as part of the effort to combat climate change and reduce energy consumption, this credit provides financial incentives to those who invest in eco-friendly home improvements.

Key features of the Energy Efficient Home Improvement Credit include:

Eligible Improvements. The credit covers a range of energy-efficient home improvements, including HVAC system upgrades, insulation installation, energy-efficient windows, and more.

Financial Benefits. Homeowners can enjoy a credit of up to 30% of the cost of qualified improvements, up to $3,200 annually.

Future Updates. These credits are allowed for qualifying expenses for product placed in service after January 1, 2023 and before January 1, 2033. You may be eligible for the maximum credit every year you make qualifying improvements until 2032, to be claimed by 2033 tax season.

Upgrading to a high-efficiency gas furnace like the Lennox Elite Series EL297V makes you eligible for the Energy Efficient Home Improvement Credit, delivering comfort and savings.

HVAC and Federal Tax Credits

Included in the Energy Efficient Home Improvement Credit, federal tax credits are available for heating, ventilation, and air conditioning (HVAC) systems. This is an excellent opportunity for homeowners to invest in energy-efficient HVAC solutions while enjoying financial benefits.

A variety of equipment is eligible, including:

- Heat Pumps

- SEER2 rating greater than or equal to 16

- EER2 rating greater than or equal to 12

- HSPF2 rating greater than or equal to 9

- Central Air Conditioners

- All Energy Star-certified packaged systems

- A split system with SEER2 rating of 16 or greater

- Gas Furnaces

- Energy Star-certified with an AFUE of 97% or greater

These credits, along with the energy savings you’ll enjoy, are a great way to save money through lower costs for HVAC upgrades and utility bills. Once you’ve installed your new qualifying product, take a few key steps to ensure you make the most of this credit:

- Keep a copy of your installation records and the manufacturer’s certification showing the efficiency rating of your system.

- Download and complete IRS Form 5695. Fill out the relevant section(s) including any additional upgrades you’ve made that qualify.

- File your form with your federal taxes! Ask your tax professional for help in ensuring you claim the maximum credit each year.

- Don’t forget to check for additional local, regional or national rebates you may qualify for with your new upgrade!

Lennox HVAC on the Forefront of Efficiency

Many Lennox systems meet the Low GWP energy efficiency requirements needed to obtain the new federal tax credit. If you have been thinking about upgrading your system(s) and would like to take advantage of these savings soon, be sure to consider a new Lennox Elite Gas Furnace or ask your certified Lennox professional for more information.

The New Lennox Elite Series EL297V Gas Furnace

The Lennox Elite Series EL297V Gas Furnace is a cutting-edge heating solution that seamlessly blends advanced technology with superior efficiency. Engineered with a two-stage heating system, this furnace delivers precise temperature control, ensuring optimal comfort and energy savings. Its variable speed motor contributes to quiet and even heating throughout the home, eliminating fluctuations and creating a consistently cozy environment.

Additional features include:

- High-efficiency 97% AFUE rating

- Energy Star certified

- Smart thermostat compatible

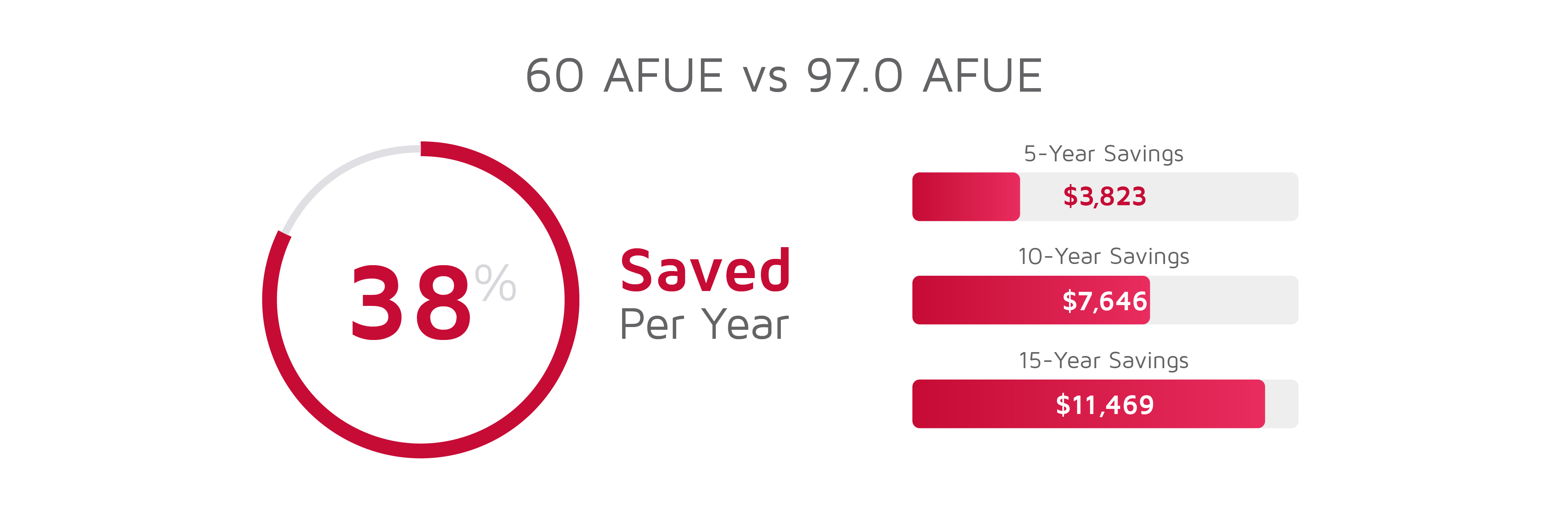

- Can lower energy bills by 20%

- Lifetime limited heat exchanger warranty

Learn more Watch the YouTube video: How to Improve Home Energy Efficiency

The New Lennox Elite Series EL297E Gas Furnace

The new Elite Series EL297E has all the features and benefits you’ve come to love and expect from Lennox, including a 25C Tax Credit eligible 97% AFUE rating. Its Power Saver™ constant-torque motor adjusts airspeed based on demand. This helps the furnace use less energy in both heating and cooling modes, and allows it to be up to 200% more efficient in constant fan mode.

Features include:

- 97% AFUE rating

- Energy Star certified

- Smart thermostat compatible

- Dual-fuel capability

- Sound absorbing, insulated design

- Can be combined with heat pump to switch between gas and electric

- Can save homeowners hundreds of dollars per year

Learn more Watch the YouTube video: How to Improve Home Energy Efficiency

Investing in a High-Efficiency Furnace

The Energy Efficient Home Improvement Credit for HVAC systems present a golden opportunity for homeowners to make environmentally conscious choices while enjoying financial benefits. The Lennox Elite Series EL297V and EL297E Gas Furnaces stand out as excellent options, providing a perfect balance of comfort, efficiency, and advanced technology. Not only will you be eligible for federal tax credits, you’ll have long-lasting savings on energy bills. Take the first step towards a greener and more cost-effective home by exploring the benefits of these programs and upgrading your HVAC system today. Contact Your Lennox Dealer to get started: https://www.lennox.com/locate/